LBT

A Practical Guide to LBT"

To understand above steps in details, let's consider an example:

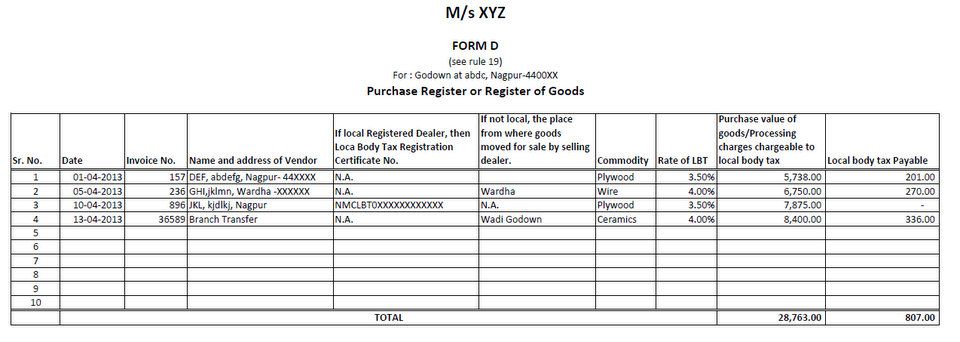

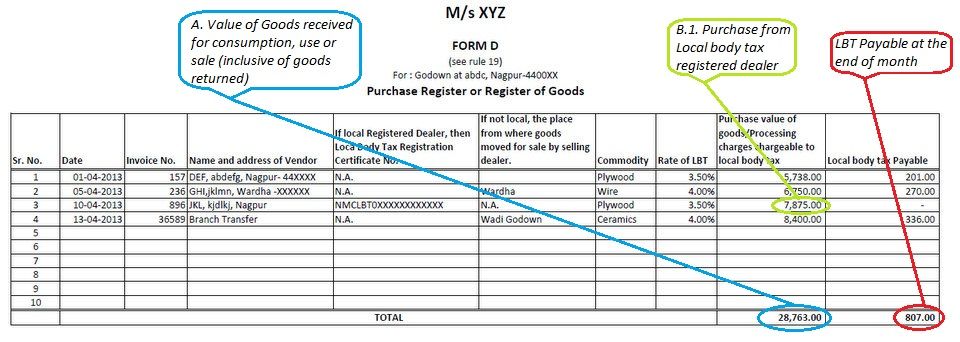

M/s XYZ is a registered dealer in LBT having one place of business in Nagpur and other in wadi. He purchases goods and takes delivery at Nagpur as well as Wadi. And following is the purchase register of M/s XYZ for the period 01/03/2013 to 30/04/2013:

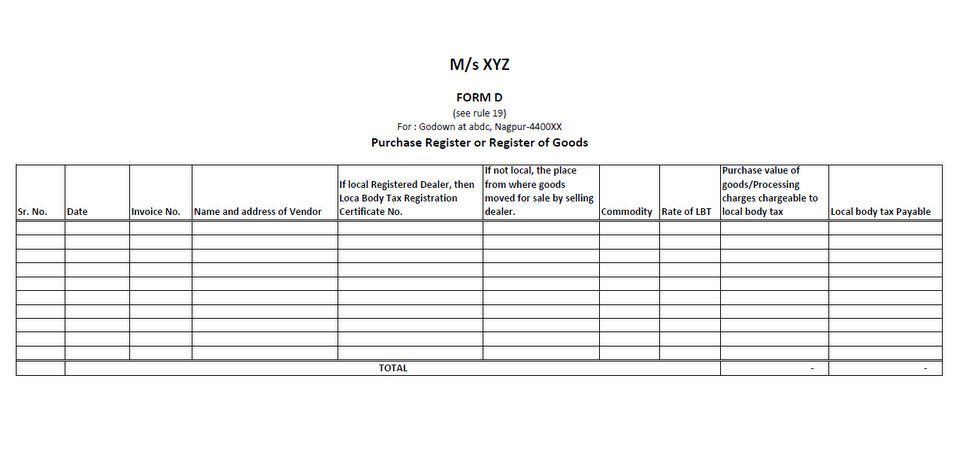

Step 1: Maintain Receipt/ purchase register for each and every place of business in Nagpur in Form D.

VAT is tax on sales; and Sales Invoice serve as a basic document for calculation and proper monitoring of VAT. On the contrary LBT is tax on purchases; more appropriately tax on entry of goods in city limits and the document which serves as basic document for calculating and monitoring LBT is Form D. So, we shall first understand the basic elements of Form D.

Form D consist of following elements:

Form D consist of following elements:

Now, continuing with our example above M/s XYZ will maintain Form D at Nagpur only, as LBT Act is not applicable outside city limits, even though it has place of business in Nagpur and Wadi. ( It is suggested to maintain detailed stock register at both places for own per usual. It will help to create reconciliation between Form D and Accounting records)

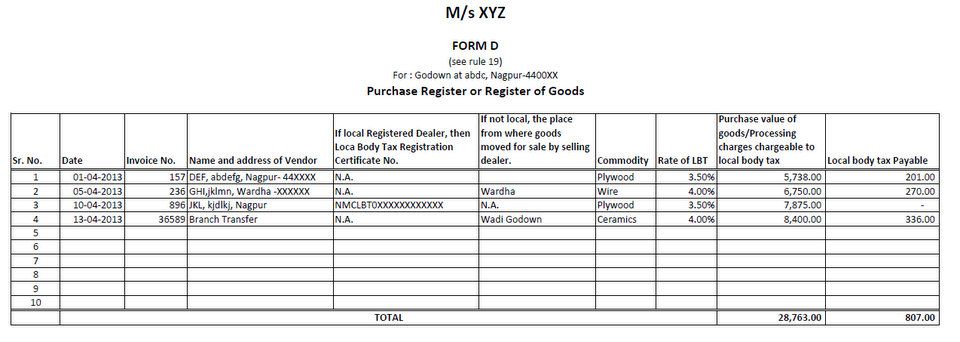

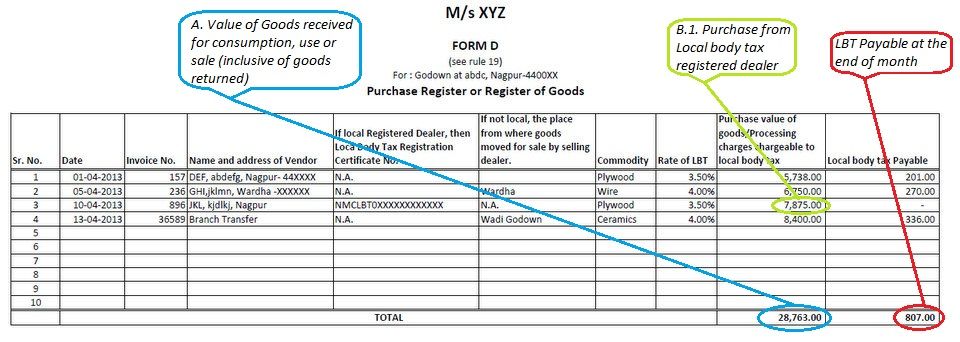

M/s XYZ will incorporate above transactions in Form D as shown in figure below.

Explained in details below :

1) Purchase from unregistered dealer will be liable to LBT. Purchase value will be Value as shown in Invoice i.e Rs. 5,738/-. Value will be inclusive of Delivery charges as the same are shown in Invoice.

2) Only Goods which are received in Nagpur should be entered and care should be taken to include place from where such goods are imported. Purchase value will be Rs. 6,750/- { [( Bill Value / Total no. of Goods) X No. of goods received in Nagpur] i.e (11,250 /10) X 6 = 6,750/-}, Delivery charges will not be included as the same are not shown in Invoice.

3) An entry will be made in Form D with LBT registration no. of dealer. Purchase value will be Rs. 7,875/- . Delivery charges will not be included as the same are not shown in Invoice and no LBT is payable on purchase from registered dealer.

4) Branch transfer will be entered in Form D as non-local purchase with place from where goods are moved being Wadi. Purchase value will be Rs. 8,400/- ( Amount Ascertained by Accounting records/ Inventory records, at cost; a figure which does not give rise to profit or loss to oneself during such transfer) on the basis of transfer voucher issued by wadi godown.

5) This purchase will not be entered in Form D, as the delivery of the same is not received in Nagpur nor purchased from Nagpur.

Few More Notes regarding Form D: -

a) Form D can be maintained in electronic records and should preferably be maintained in electronic form, more preferably incorporated into accounting system itself. ( A new version of Tally.ERP 9 Series A Release 4.61 has incorporated LBT in its accounting but it still needs add-ons to function fully)

b) Records to Be Maintained In Support Of Form D:

Explained in details below :

1) Purchase from unregistered dealer will be liable to LBT. Purchase value will be Value as shown in Invoice i.e Rs. 5,738/-. Value will be inclusive of Delivery charges as the same are shown in Invoice.

2) Only Goods which are received in Nagpur should be entered and care should be taken to include place from where such goods are imported. Purchase value will be Rs. 6,750/- { [( Bill Value / Total no. of Goods) X No. of goods received in Nagpur] i.e (11,250 /10) X 6 = 6,750/-}, Delivery charges will not be included as the same are not shown in Invoice.

3) An entry will be made in Form D with LBT registration no. of dealer. Purchase value will be Rs. 7,875/- . Delivery charges will not be included as the same are not shown in Invoice and no LBT is payable on purchase from registered dealer.

4) Branch transfer will be entered in Form D as non-local purchase with place from where goods are moved being Wadi. Purchase value will be Rs. 8,400/- ( Amount Ascertained by Accounting records/ Inventory records, at cost; a figure which does not give rise to profit or loss to oneself during such transfer) on the basis of transfer voucher issued by wadi godown.

5) This purchase will not be entered in Form D, as the delivery of the same is not received in Nagpur nor purchased from Nagpur.

Few More Notes regarding Form D: -

a) Form D can be maintained in electronic records and should preferably be maintained in electronic form, more preferably incorporated into accounting system itself. ( A new version of Tally.ERP 9 Series A Release 4.61 has incorporated LBT in its accounting but it still needs add-ons to function fully)

b) Records to Be Maintained In Support Of Form D:

Summarise Form D as mentioned below at the end of month for filling Return on later date.

1) Calculation of Turnover Liable To LBT:

Summarise Form D as mentioned below at the end of month for filling Return on later date.

1) Calculation of Turnover Liable To LBT:

2) Rate wise Calculation Amount Payable:

Step 3: Pay The LBT as calculated above in return cum challan on or before 20th day of next month.

Step 4: Repeat the above mentioned procedure "Step 1 to 3" throughout the year i.e from April to March.

Step 5: File the E-I return for April to September, on or before 15th of October.

Summarise the Calculation done at the end of step 2 for Six Months i.e from April to September. Fill in form E-I and submit it to the NMC office.

Step 6: File E-II return for April to March, on or before 15th April of Next Year.

Repeat the step mentioned in Step 5 for whole year. Fill in form E-II and submit it to the NMC office on or 15 th April.

It may be noted that dates mentioned in Step 5 and 6 are sought to be revised.

Few other important points:

Step 4: Repeat the above mentioned procedure "Step 1 to 3" throughout the year i.e from April to March.

Step 5: File the E-I return for April to September, on or before 15th of October.

Summarise the Calculation done at the end of step 2 for Six Months i.e from April to September. Fill in form E-I and submit it to the NMC office.

Step 6: File E-II return for April to March, on or before 15th April of Next Year.

Repeat the step mentioned in Step 5 for whole year. Fill in form E-II and submit it to the NMC office on or 15 th April.

It may be noted that dates mentioned in Step 5 and 6 are sought to be revised.

Few other important points:

| Sr. No. | Date of Purchase | Date of Receipt In Nagpur | Particulars | Qty | Amount (Rs.) | ||||||||

| 1) | 31/03/2013 | 01/04/2013 | Purchased Plywood from: DEF, abdefg, Nagpur- 44XXXX ; who is a local dealer not registered for LBT. For delivery at: Nagpur.

Invoice details:

| 5 | 5,738.00 | ||||||||

| 2) | 01/04/2013 | 05/04/2013 | Purchased Wire from: GHI,jklmn, Wardha -XXXXXX ; who is a dealer located in Wardha (i.e. other City). For delivery at: Nagpur 6 Units and Wadi 4 Units.

Invoice details:

| 10 | 11,250.00 | ||||||||

| 3) | 09/04/2013 | 10/04/2013 | Purchased Plywood from: JKL, kjdlkj, Nagpur; who is a registered LBT dealer. For delivery at: Nagpur.

Invoice details:

| 7 | 7,875.00 | ||||||||

| 4) | 13/04/2013 | M/s XYZ transfers 8 ceramic items form his Wadi Godown to Nagpur | 8 | 0.00 | |||||||||

| 5) | 10/04/2013 | N.A. | Purchased Plywood from: JKL, kjdlkj, Nagpur-MIDC (i.e. out of City limit). For delivery at: Pune.

Invoice details:

| 25 | 29,250.00 | ||||||||

| TOTAL PURCHASE | 54,113.00 | ||||||||||||

Form D consist of following elements:

Form D consist of following elements:

| 1) Sr. No. | Entries in the Form D must be chronologically arranged i.e. dated and serially arranged. |

| 2) Date | Date in Form D means date of receipt in City and not the date of purchase. |

| 3) Invoice No. | Invoice number means invoice number of purchase bill or transfer slip number in case of branch transfer. |

| 4) Name and address of Vendor | Name and address of selling vendor must be maintained in Form D |

| 5) If local Registered Dealer, then Local Body Tax Registration Certificate No. | If purchase is from LBT registered local dealer, then LBT R. C. number of such dealer must be entered in Form D. As purchase from such registered dealer is not taxable. |

| 6) If not local, the place from where goods moved for sale by selling dealer. | If purchase is from dealer who is outside city limits or branch transfer from outside city limits, then a place must be mentioned in Form D from where such goods are moved from. |

| 7) Commodity | As LBT is paid on value of commodity; particulars of commodity must be mentioned in Form D |

| 8) Rate of LBT | As LBT is paid on value of commodity; rate at which commodity is taxable must be mentioned in Form D |

| 9) Purchase value of goods/Processing charges chargeable to local body tax | Purchase value has not been defined in LBT Act. On perusal of relevant provision it appears that LBT is required to be paid on the invoice price charged in a particular transaction and in case of Branch transfer means the value of goods ( cost of goods; i.e price at which no profit or loss arise to oneself in case of branch transfer). This requires clarification from the authorities |

| 10) Local body tax Payable | This is the final column in Form D which is tax payable, calculated for each and every taxable transaction in Form D. |

Explained in details below :

1) Purchase from unregistered dealer will be liable to LBT. Purchase value will be Value as shown in Invoice i.e Rs. 5,738/-. Value will be inclusive of Delivery charges as the same are shown in Invoice.

2) Only Goods which are received in Nagpur should be entered and care should be taken to include place from where such goods are imported. Purchase value will be Rs. 6,750/- { [( Bill Value / Total no. of Goods) X No. of goods received in Nagpur] i.e (11,250 /10) X 6 = 6,750/-}, Delivery charges will not be included as the same are not shown in Invoice.

3) An entry will be made in Form D with LBT registration no. of dealer. Purchase value will be Rs. 7,875/- . Delivery charges will not be included as the same are not shown in Invoice and no LBT is payable on purchase from registered dealer.

4) Branch transfer will be entered in Form D as non-local purchase with place from where goods are moved being Wadi. Purchase value will be Rs. 8,400/- ( Amount Ascertained by Accounting records/ Inventory records, at cost; a figure which does not give rise to profit or loss to oneself during such transfer) on the basis of transfer voucher issued by wadi godown.

5) This purchase will not be entered in Form D, as the delivery of the same is not received in Nagpur nor purchased from Nagpur.

Few More Notes regarding Form D: -

a) Form D can be maintained in electronic records and should preferably be maintained in electronic form, more preferably incorporated into accounting system itself. ( A new version of Tally.ERP 9 Series A Release 4.61 has incorporated LBT in its accounting but it still needs add-ons to function fully)

b) Records to Be Maintained In Support Of Form D:

Explained in details below :

1) Purchase from unregistered dealer will be liable to LBT. Purchase value will be Value as shown in Invoice i.e Rs. 5,738/-. Value will be inclusive of Delivery charges as the same are shown in Invoice.

2) Only Goods which are received in Nagpur should be entered and care should be taken to include place from where such goods are imported. Purchase value will be Rs. 6,750/- { [( Bill Value / Total no. of Goods) X No. of goods received in Nagpur] i.e (11,250 /10) X 6 = 6,750/-}, Delivery charges will not be included as the same are not shown in Invoice.

3) An entry will be made in Form D with LBT registration no. of dealer. Purchase value will be Rs. 7,875/- . Delivery charges will not be included as the same are not shown in Invoice and no LBT is payable on purchase from registered dealer.

4) Branch transfer will be entered in Form D as non-local purchase with place from where goods are moved being Wadi. Purchase value will be Rs. 8,400/- ( Amount Ascertained by Accounting records/ Inventory records, at cost; a figure which does not give rise to profit or loss to oneself during such transfer) on the basis of transfer voucher issued by wadi godown.

5) This purchase will not be entered in Form D, as the delivery of the same is not received in Nagpur nor purchased from Nagpur.

Few More Notes regarding Form D: -

a) Form D can be maintained in electronic records and should preferably be maintained in electronic form, more preferably incorporated into accounting system itself. ( A new version of Tally.ERP 9 Series A Release 4.61 has incorporated LBT in its accounting but it still needs add-ons to function fully)

b) Records to Be Maintained In Support Of Form D:

- Copy of Invoice

- Delivery challan - showing movements of goods

- Goods Transfer Slip in case of Branch Transfer

Summarise Form D as mentioned below at the end of month for filling Return on later date.

1) Calculation of Turnover Liable To LBT:

Summarise Form D as mentioned below at the end of month for filling Return on later date.

1) Calculation of Turnover Liable To LBT:

| Particulars | Amount (Rs.) |

| A. Value of Goods received for consumption, use or sale (inclusive of goods returned) | 28,763.00 |

| B. Deduct.- | |

| 1. Purchase from Local body tax registered dealer | 7,875.00 |

| 2.Exempted Purchase (Tax free u/s 152Q) | Nil |

| 3.Exempted for Govt Purchase (u/r 28) | Nil |

| 4.Value of goods imported for export u/r 32 | Nil |

| 5.Goods Purchase Return within 6 months | Nil |

| Balance Purchase Turnover liable for LBT as per Scheduled Entry Rate | 20,888.00 |

| Commodity Imported (Received) | Goods Covered By Schedule Entry | Rate of Local Body Tax Applicable | Value of Goods Liable For Local Body Tax Amount (Rs.) | Amount of Local Body Tax Payable Amount (Rs.) |

| Plywood | Sch. A | 3.5% | 5,738.00 | 201.00 |

| Wire | Sch. A | 4% | 6,750.00 | 270.00 |

| Ceramics | Sch. A | 4% | 8,400.00 | 336.00 |

| TOTAL | 20,888.00 | 807.00 | ||

Step 4: Repeat the above mentioned procedure "Step 1 to 3" throughout the year i.e from April to March.

Step 5: File the E-I return for April to September, on or before 15th of October.

Summarise the Calculation done at the end of step 2 for Six Months i.e from April to September. Fill in form E-I and submit it to the NMC office.

Step 6: File E-II return for April to March, on or before 15th April of Next Year.

Repeat the step mentioned in Step 5 for whole year. Fill in form E-II and submit it to the NMC office on or 15 th April.

It may be noted that dates mentioned in Step 5 and 6 are sought to be revised.

Few other important points:

Step 4: Repeat the above mentioned procedure "Step 1 to 3" throughout the year i.e from April to March.

Step 5: File the E-I return for April to September, on or before 15th of October.

Summarise the Calculation done at the end of step 2 for Six Months i.e from April to September. Fill in form E-I and submit it to the NMC office.

Step 6: File E-II return for April to March, on or before 15th April of Next Year.

Repeat the step mentioned in Step 5 for whole year. Fill in form E-II and submit it to the NMC office on or 15 th April.

It may be noted that dates mentioned in Step 5 and 6 are sought to be revised.

Few other important points:

- Invoice under LBT Act is different from that of VAT invoice. Hence M/s XYZ will have to maintain two set sales Invoices one for Sale from Nagpur and Other for sale from Wadi. ( Same can also be achieved by stamping LBT requirements on regular invoice)

- LBT regulation provides for refund/ drawback at ninety per cent of LBT paid on Exports but as no export rules have been notified yet, export of goods has been intentionally left out of above example. The same will be updated as and when these are notified or explained by authorities in details.

- As the introduction of VAT led to requirement of improving in Accounting of Sales and purchase transactions and recordkeeping. Introduction of LBT has led to need of improvement of Stock Records. So let's consider this an opportunity for one more improvement.

- Rule 26 gives right to inspection of goods in transit, etc to Inspector of LBT, requiring to give details of consignor, consignee and goods. This in essence along with other requirements of LBT Act and Rules means that, No Goods Should Enter City without A Proper Invoice. So a practice must be developed to send goods with Invoice only. This in return will also help other LBT registered dealers to account for receipt of goods in time and with proper value in his Form D.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Created with Artisteer

Created with Artisteer

Subscribe to:

Posts

(Atom)

Very good article

ReplyDeletegood work guys.. Thanks

ReplyDelete